Contents:

MercadoLibre is an Argentine company incorporated in the U.S. that operates online marketplaces dedicated to e-commerce and online auctions. Starting in November 2017, users could begin buying and selling bitcoin on the Cash App. Jack has been an advocate for Bitcoin, and Bitcoin only, when it comes to cryptocurrencies.

- The company makes its mark as a platform that consumers can use to buy, store, and sell cryptocurrencies.

- The firm gives its clients access to business-building information, experiences, and products.

- Finance and banking in India will undergo fundamental shifts due to Fintech’s ability and power.

By aggregating information from numerous institutions, many of the earliest tech disputes adjudication: a new forum for dispute resolution apps and websites helped individuals manage their budgets. Additionally, mortgage origination platforms have existed for some time. These websites enable customers to obtain mortgage quotations from various lenders through a single application. It has taken tech businesses a long time to disrupt the insurance market because a substantial critical mass is necessary. However, since competition in other fintech industries has intensified, more capital may be invested in insurance-focused fintech startups. Open banking legislation permits users to grant third-party service providers access to their bank account and investment information.

IBD Stock Of The Day

Regulation has often been a thorny issue in the fintech world, as in any other industry, with most major players viewing it with suspicion and terming it bad for business. However, unregulated digital markets have the power to wreak havoc, as recent stock market fluctuations based on meme wars have exhibited. Fintech is also susceptible to hacking, which often leaves users vulnerable not only because their money might be stolen but their data as well. All these considerations need to be taken into account to develop a sound policy on fintech.

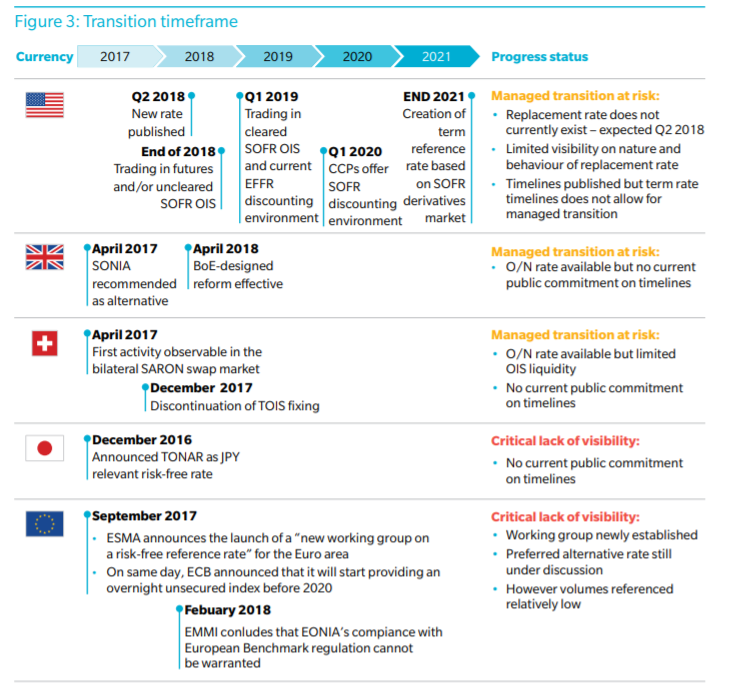

Fintech companies develop a variety of software platforms, apps, hardware solutions, and more to achieve these goals. Also, many people were wrong about what would happen to banks once money started costing money. I figured rising loan prices would cause yield spreads, the difference between what banks pay depositors and what they collect from debtors, would rise. But the value of the government loans banks use to back their deposits, and their capital, fell. The technology could play a role in securities clearing and settlement, digital identity and payments as soon as 2025, say the most bullish observers. Blockchain is the software technology behind Bitcoin and other cryptocurrencies.

What are the five elements/technologies of fintech?

Mobile payments and banking services have made a significant impact in emerging markets economies where very few people have access to traditional bank accounts. Open banking and mobile phones are also enabling fintech innovation. Open banking regulations allow consumers to give third party service providers access to data related to bank accounts and investments. This allows consumers to shop around for financial services, rather than being forced to use those offered by institutions.

The tech-heavy Nasdaq-100 has been ticking upwards since the beginning of the year, pointing to a more conducive market for relatively risky stocks. That said, let’s dive into the most promising fintech stocks to buy for April. As the leading international money transfer choice, it moves more than $5 billion every month. The company offers users the ability to move funds from one bank to another on low rate exchanges.

Blockchain May Figure In Fintech Future

Any investment decision is made by each client alone whereas Admirals shall not be responsible for any loss or damage arising from any such decision, whether or not based on the content. The content is published for informative purposes only and is in no way to be construed as investment advice or recommendation. MA has begun moving into the cryptocurrency space, perhaps most notably from its recent acquisition of CipherTrace, an intelligence firm working to prevent fraud and protect digital assets. It uses customers’ details to evaluate the user’s eligibility and decide the credit limit. MoneyTap was launched in 2015 by Bala Parthasarathy, Kunal Verma, and Anuj Kacker. The company is backed by investors such as Berkshire Hathaway, China’s Ant Group, and Japan’s SoftBank.

Square seems committed to expanding its suite of products and acquiring smaller companies in the fintech space. This company is relatively small when compared to some of the other stocks on this list. Integrated bank charter services are becoming an increasingly important part of Green Dot’s income, as major companies like Apple and Uber use these services. The company’s revenue has grown consistently over the past several years, and this has been reflected in its stock performance. India’s fintech scene has remained confined mainly to tier 1 cities in the last few years.

Types of fintech stocks

Analysts were pleased with the company’s results, including Lisa Ellis, senior managing director at MoffettNathanson. “After a wild ride over the past 2.5 years, Block’s business is emerging from the pandemic stronger than ever,” Ellis wrote in a note to clients, per Barron’s. Block reported better-than-expected third-quarter results on Nov. 3, causing shares to jump 11.5% in a day. Another way it looks out for customers is by protecting their trading information to prevent sophisticated investors from front-running their orders and increasing the transaction cost. Its secret to success is providing top-notch customer service and considering clients’ needs when designing its platform.

On the surface, Paysafe looks similar to Paypal and offers some of the same services. Its adoption of iGaming is what really separates the company from other digital payment providers. Many others looked at it as a risky industry niche to go into, but Paysafe viewed it as a unique opportunity. Now, its digital wallets are by far the most popular that get used in digital gambling worldwide. The company has seen a massive amount of growth in the first half of the year, and it shows no signs of stopping. Stripe is a SaaS company that provides an API that ecommerce companies use to integrate payment processing on their websites.

Coinbase went public on the Nasdaq in 2021, with a price per share set at $250. Apps for stock trading, such as Robinhood, make investing in stocks very simple for individual investors. These businesses prioritize the simplification of the investing process and the delivery of a smooth customer experience. Crowdfunding and lending – Peer-to-peer financing platforms promote loans and fundraising for individuals, small enterprises, and organizations. P2P financing is advantageous for both lenders and borrowers since intermediary margins are eliminated.

What is a FinTech company?

India’s fintech industry is the fastest growing industry in the world. Payment apps such as Paypal, Venmo, Stripe, Google Pay and Apple Pay have been steadily increasing in recent years as well. Paypal currently has 377 Million active users, with many of their competitors not far behind. As part of its transformation efforts, PayPal is targeting a cost reduction of $900 million in 2022 and savings of at least $1.3 billion in 2023.

Currently, the company stock – under the ticker COIN – is trading slightly above $57. The company went public on the Nasdaq in 2002, and since then, it managed to acquire over 200 million users worldwide. Elliott Wave Forecast is a leading technical analysis firm helping traders around the world make smarter trading decisions. Daily coverage of Stocks, ETFs, Indices, Forex, Commodities, Bonds & Cryptocurrencies.

Why Square Can Reach ‘Holy Grail’ Of Fintech Companies – Investor’s Business Daily

Why Square Can Reach ‘Holy Grail’ Of Fintech Companies.

Posted: Thu, 16 Mar 2023 07:00:00 GMT [source]

However, volatility will create the best opportunities to make fintech investments. The term fintech covers a wide variety of companies, ranging from more established players, such as PayPal, to a constant stream of new comers attempting to democratise the financial services industry. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

Another option is reading one of our in depth reviews or guides to gain more information about certain https://1investing.in/s or brokerages. Our comparison tools, research articles and reviews are easy to read, use and totally independent. This makes sure that you know everything from A to Z about your potential investment.

These Are 3 of the Best Growth Stocks to Buy in April – Nasdaq

These Are 3 of the Best Growth Stocks to Buy in April.

Posted: Wed, 05 Apr 2023 12:30:00 GMT [source]

If you’re unfamiliar, Fin-Tech refers to digital innovations that improve and automate financial services delivery, and FinTech includes both financial technology and financial services. Toast’s all-in-one software platform powers a remarkable 74,000 restaurants across the U.S. and is just beginning to tap into a colossal market of over a million locations. The company’s impressive ARR skyrocketed from $326 million in 2020 to a whopping $901 million last year. Moreover, its net retention rate, an important gauge to assess the annual revenue generated from its loyal customer base customers, climbed from 121% in 2020 to 128% by the year-end. As Toast continues to expand its offerings, it’s undoubtedly a fintech force to keep tabs on for the long haul. Although 2022 proved to be a challenging year for fintech stocks to buy, 2023 offers a more optimistic outlook.